Table of Content

Key Takeaways

- Sales-ready leads have budget, authority, need, and urgency - interest and intent alone aren't enough to justify sales team involvement.

- Readiness definitions must match your specific deal size and sales cycle - cookie-cutter frameworks break when applied universally across different B2B models.

- MQLs and SQLs aren't automatically sales-ready - engagement scores and basic qualification don't equal buying intent with timeline.

- Look for multiple readiness signals combined - timeline mentions, budget discussions, stakeholder involvement, and pain specificity together indicate true readiness.

- Misalignment between teams kills pipeline quality - when marketing, SDRs, sales, and leadership define readiness differently, you waste time on leads that never close.

- Quality beats quantity every time - focus on generating fewer, genuinely ready leads rather than filling your CRM with contacts that won't convert.

Let's cut through the noise. Everyone talks about sales ready leads, but most B2B teams are chasing the wrong definition.

You're probably wasting time on leads that look good on paper but never convert.

We've generated over 53,000 appointments for B2B companies, and here's what we learned: the difference between a qualified lead and a sales ready lead can make or break your revenue targets.

This guide shows you what sales-ready leads actually are, how to identify them, and how to build a system that delivers them consistently.

No fluff, just what has worked for us and will most definitely work for you as well.

What Is a Sales-Ready Lead?

A sales ready lead is someone who has the authority, budget, and immediate need for your solution, and they're actively looking to make a decision now. Not next quarter. Not "sometime soon." Now.

Here's where most teams get it wrong. They confuse three different things:

- Interest - They downloaded your ebook or visited your pricing page. Cool, but that's just curiosity.

- Intent - They're researching solutions and comparing options. Getting warmer, but they might be 6 months out.

- Readiness - They have budget approved, decision-makers aligned, and they're ready to talk implementation. This is your sales ready lead.

The tricky part?

Sales-ready leads look different depending on your deal size and sales cycle. A $5K software sale needs different readiness signals than a $500K enterprise contract.

For us at Cleverly, a sales ready lead means they've responded positively to outreach, confirmed their role, and agreed to a specific meeting time to discuss their lead generation challenges.

Common myths that waste your time:

- "Any lead who fills out a form is sales-ready" - Wrong. Form fills measure interest, not buying intent.

- "MQLs from marketing are automatically sales-ready" - Not even close. Marketing qualified doesn't mean purchase-ready.

- "If they have budget and authority, they're ready" - Missing piece: urgency. Without timeline pressure, they'll stay in research mode forever.

The reality? Most B2B sales ready leads need 3-5 meaningful interactions before they're actually ready for your sales team. Pushing too early kills the deal. Waiting too long and competitors swoop in.

Learn More: MQL vs SQL - What’s the Difference and How to Approach Each?

Why "Sales-Ready" Means Different Things Across B2B Teams

Your sales-ready leads definition should match your business reality, not some textbook framework.

A SaaS company selling $500/month subscriptions defines readiness completely differently than an agency closing $50K contracts.

How your business model shapes readiness

- Transactional sales (under $10K deals) - A sales ready lead might just be someone who booked a demo and has decision-making authority. Your sales cycle is days or weeks, so readiness happens fast.

- Consultative sales ($10K-$100K) - Now you need multiple stakeholders engaged, budget confirmed, and a clear problem they're trying to solve. Readiness takes weeks to months.

- Enterprise sales ($100K+) - Sales-ready leads here means champions identified, business case built, and procurement involved. We're talking months of nurturing before they're truly ready.

The internal disconnect nobody talks about

Your founder thinks any interested prospect is sales-ready because they're optimistic. Your marketers call leads ready after they hit a lead score threshold.

Your SDRs say leads are ready when they book a meeting. Your AEs insist leads aren't ready until budget is confirmed and pain is acute.

Who's right? Everyone and no one.

The problem isn't the people, it's that you haven't aligned on what sales-ready leads mean for your specific business.

Deal size and sales cycle change everything:

- Short cycle, low ACV - Readiness = urgency and authority

- Medium cycle, mid ACV - Readiness = budget, authority, need, and timeline

- Long cycle, high ACV - Readiness = business case, stakeholder alignment, and competitive evaluation complete

At Cleverly, we've worked with companies across all these models. The teams that generate sales-ready leads consistently have one thing in common: they've defined readiness based on their actual deal metrics, not generic BANT criteria.

Why cookie-cutter definitions fail

When you scale, generic definitions create chaos. Marketing sends over "qualified" leads that sales rejects. Sales complains about lead quality while sitting on unworked opportunities. Revenue suffers because nobody agrees on what ready actually means.

The fix isn't better lead scoring. It's building a readiness definition that matches your sales motion, then getting every team to operate from that same playbook.

Read More: Proven & Scalable Methods to Increase Your B2B Sales Pipeline

How Different B2B Teams Define a Sales-Ready Lead

Here's why your pipeline is a mess. Every team has their own version of what B2B sales ready leads look like.

Marketing's lens: Signals and scores

Your marketing team tracks engagement metrics. They call a lead sales-ready when someone hits their lead score threshold, matches your ICP, and shows intent signals like pricing page visits or content downloads. Problem? High engagement doesn't equal high buying intent.

SDR perspective: Conversation quality

SDRs live in the replies. For them, B2B sales ready leads are prospects who respond with detailed questions, mention current challenges, or ask about implementation timelines. They're looking for conversation depth, not just a "yes" to a meeting.

Sales team reality check: BANT 2.0

Your AEs want budget confirmed, decision-maker involved, urgent pain identified, and a clear timeline. Anything less and they'll push it back to SDRs or let it sit in the pipeline forever. They've been burned too many times by "ready" leads that weren't actually ready.

Leadership's calculation: Revenue predictability

Executives don't care about your qualification framework. They want B2B sales ready leads that convert predictably and move through the pipeline at consistent velocity. If your "ready" leads have a 15% close rate, they're not actually ready.

The disconnect costs you deals

When marketing passes leads that SDRs reject, or SDRs book meetings that sales can't close, you're not just wasting time. You're burning budget on leads that were never truly sales-ready in the first place.

The solution? Get all four groups in a room and build one unified definition based on what actually closes deals, not what makes each team's metrics look good.

Explore More: Perfect B2B Sales Strategy to Close More Deals (Proven Methods)

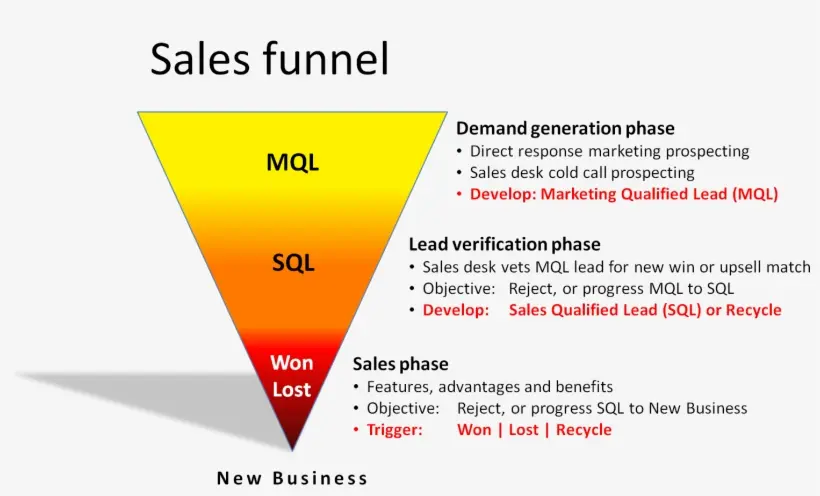

Sales-Ready Lead vs MQL vs SQL

Most B2B teams use these terms interchangeably. Big mistake. Here's what they actually mean and why the differences matter.

MQL (Marketing Qualified Lead): Someone who's engaged with your marketing content and fits your ideal customer profile. They downloaded an ebook, attended a webinar, or hit a lead score threshold. That's it. They're interested, but interest doesn't pay the bills.

SQL (Sales Qualified Lead): A lead that's been vetted by your SDR team. They've confirmed fit, identified a need, and agreed to talk to sales. Better than an MQL, but still not necessarily ready to buy.

Sales Ready Lead: This is the one that actually matters. They have budget, authority, a clear need, and urgency. They're not just willing to take a call, they're actively evaluating solutions and ready to make a decision.

The MQL trap in outbound:

Here's what kills most outbound programs. You're doing cold outreach, someone replies positively and books a meeting. Marketing labels them an MQL because they engaged. But in outbound, that first reply isn't qualification, it's just the start of the conversation.

A sales ready lead from cold outreach needs multiple touchpoints.

We've booked 53,000+ appointments, and the pattern is clear: reply, qualification call, stakeholder identification, then they're actually ready for sales. Treating that first reply as sales-ready sets your AEs up for failure.

When SQLs aren't ready either

Your SDR confirms the lead has authority and budget. They book the meeting. Sales team gets on the call and discovers:

- Budget isn't actually approved yet.

- The "decision-maker" needs to loop in three other people.

- They're in early research mode with no timeline.

- They're just price shopping against their current vendor.

That SQL? Not a sales ready lead. It's a qualified opportunity that needs more nurturing.

Moving beyond funnel theater

Smart B2B teams are ditching rigid MQL/SQL labels. Instead, they focus on readiness indicators that actually predict closes.

At Cleverly, we don't just generate sales-ready leads based on arbitrary scores. We qualify for actual buying intent: confirmed pain, active evaluation, and decision timeline.

The practical difference

- MQLs fill your CRM with vanity metrics

- SQLs fill your pipeline with maybes

- Sales-ready leads fill your bank account with closed deals

Stop optimizing for lead volume. Start optimizing for actual readiness.

Compare: Lead Quality vs Quantity

Signals That Indicate a Lead Is Truly Sales-Ready

You need to separate window shoppers from actual buyers. How to spot sales-ready leads before your sales team wastes hours on tire kickers.

Explicit signals: They're telling you directly

These are the obvious ones, but most teams still miss them:

- Reply intent - They respond with specific questions about implementation, pricing tiers, or contract terms (not just "tell me more").

- Meeting requests - They proactively suggest times or ask to bring in other stakeholders.

- Internal referrals - They cc their boss or ask you to connect with their team.

- Timeline mentions - They reference specific dates: "We need this in place by Q2" or "Our current contract ends in March".

- Budget discussions - They ask about payment terms or mention their allocated budget range.

Implicit signals: Read between the lines

Sales-ready leads often show readiness without saying it directly:

- Pain specificity - They describe their exact problem with numbers: "We're spending 40 hours a week on manual prospecting".

- Current solution dissatisfaction - They mention frustrations with their existing vendor or process.

- Role confirmation - They explain their decision-making authority without you asking.

- Competitive context - They mention other solutions they're evaluating (means they're in active buying mode).

- Follow-up consistency - They respond quickly and keep the conversation moving.

The high-intent trap

Someone downloads your pricing guide, visits your site five times, and reads every case study. High intent, right? Not necessarily sales-ready leads.

Intent signals show interest and research behavior. Readiness signals show buying timeline and decision authority. You need both.

We've seen countless leads show massive intent signals but they're 6-12 months from actually purchasing. Great for lead nurturing, terrible for your sales team's quota this quarter.

Curiosity vs commitment

Curiosity looks like:

- "This seems interesting, tell me more"

- Generic questions about features

- Asking for demos without mentioning their specific needs

- Radio silence after initial engagement

Commitment looks like:

- "Here's our exact challenge, can your solution handle this?"

- Questions about onboarding timeline and implementation support

- Involving multiple stakeholders in conversations

- Consistent follow-through and response rates

The reality check

True sales-ready leads usually show at least 3-4 of these signals combined. One signal isn't enough. A pricing page visit plus a generic inquiry? Not ready. A detailed pain description plus timeline mention plus stakeholder involvement? That's your green light.

What Prevents Leads From Becoming Sales-Ready

You're not failing to generate sales-ready leads because of bad luck. Here's what's actually breaking your pipeline:

Targeting the wrong people from the start:

- Your ICP is too broad or based on guesswork, not closed-won data.

- You're chasing titles instead of actual decision-makers.

- Firmographic fit doesn't match psychographic readiness (right company, wrong timing).

Rushing the handoff:

- Marketing passes leads after one content download.

- SDRs book meetings without proper qualification.

- Sales gets "ready" leads that haven't been warmed up enough.

- No one agrees on what qualifies as ready, so everyone pushes leads forward prematurely.

Generic outreach kills readiness:

- Templated messages that could go to anyone.

- No research into their actual business challenges.

- Talking about your features instead of their problems.

- Copy-paste personalization that prospects see right through.

Automation without intelligence:

- Sequences that blast hundreds of prospects identically.

- No qualification gates before advancing to next steps.

- Lead scoring based on activity, not buying intent.

- Chatbots collecting info without assessing readiness

Internal misalignment:

- Marketing optimizes for MQL volume, sales wants quality.

- SDRs measured on meetings booked, not meetings that close.

- AEs cherry-pick opportunities and ghost the rest.

- No feedback loop to tell marketing which leads actually converted.

The common thread?

Most teams optimize for quantity over readiness. They want more leads in the pipeline instead of better leads.

Fix the foundation:

- Tighten your ICP based on closed deals, not assumptions.

- Build qualification checkpoints at every stage.

- Personalize based on actual research, not mail merge fields.

- Align your teams on one readiness definition.

- Measure what matters: conversion rates, not lead volume.

You can't scale broken. Fix these issues first, then focus on volume.

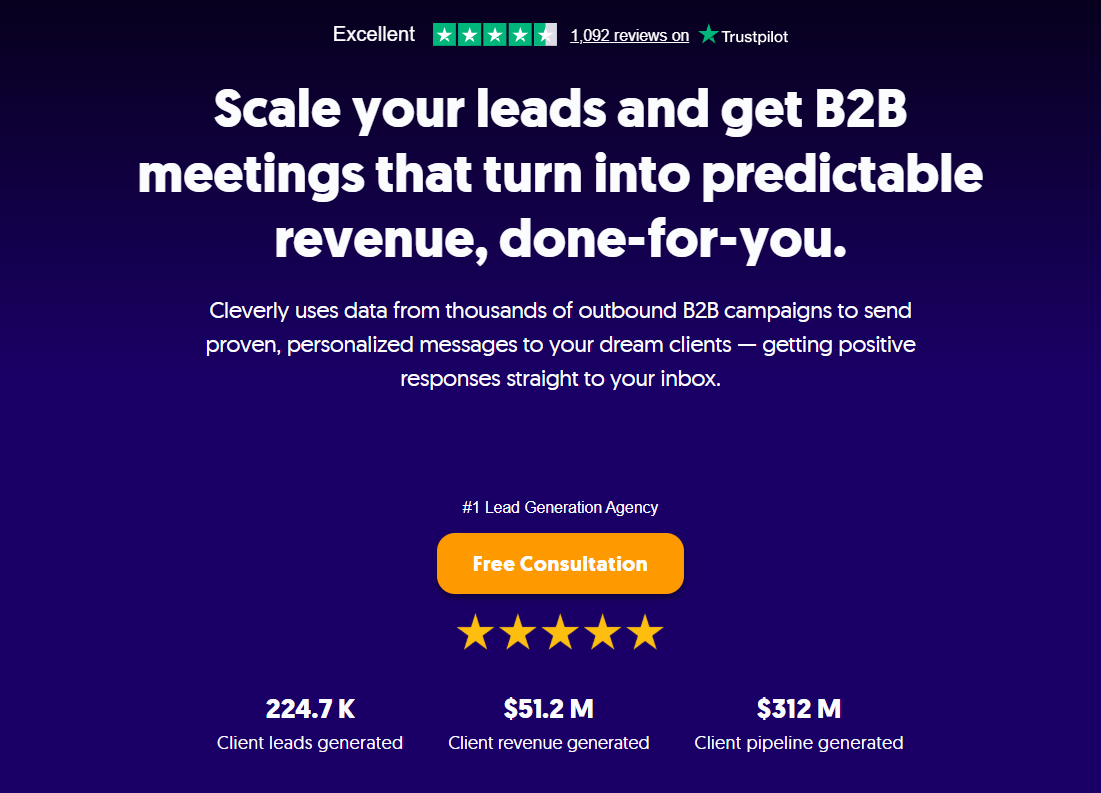

How Cleverly Helps Teams Generate Sales-Ready Leads (Not Just More Leads)

Most lead generation agencies dump unqualified contacts into your CRM. We don't do that.

What makes us different:

- Qualified conversations, not form fills - We book actual meetings with decision-makers who've confirmed their interest, not random downloads.

- Multi-channel outreach that builds readiness - LinkedIn, cold email, and cold calling working together to warm up prospects before they hit your calendar.

- We qualify before handoff - Every lead is vetted for pain, authority, and timeline before your sales team touches it.

- Pay for results, not hope - Cold email services charge per meeting-ready lead, not per contact or activity.

- Half your team's workload, double the quality - Our system replaces the grunt work while delivering conversations your AEs actually want to take.

The Cleverly difference:

- 53,000+ appointments set (not just leads generated)

- $312M in pipeline created for clients

- 10,000+ B2B companies trust us, including Amazon, Google, Uber, PayPal.

Why sales teams prefer us:

- No more "they weren't actually interested" excuses.

- Meetings show up ready to discuss solutions.

- Your AEs spend time closing, not chasing ghosts.

- Predictable pipeline you can actually forecast from.

We're not a lead vendor. We're your sales-readiness partner.

If your sales team needs conversations—not contacts—Cleverly helps create sales-ready leads consistently.

Conclusion

There's no universal definition for sales-ready-leads that works for every B2B company. Your deal size, sales cycle, and business model determine what readiness actually looks like.

The teams struggling with pipeline quality are the ones using cookie-cutter frameworks. They're forcing leads through rigid MQL and SQL stages that don't match their actual buying process.

The result? Bloated CRMs, frustrated sales teams, and terrible conversion rates.

What actually works is defining what a sales ready lead means for your specific business. Getting marketing, SDRs, sales, and leadership aligned on that definition. Then building your entire system around delivering leads that match those criteria, not just hitting arbitrary activity metrics.

When everyone agrees on readiness, everything improves. Your pipeline becomes predictable. Your close rates go up. Your sales team stops complaining about lead quality because you're finally sending them prospects who are actually ready to buy.

Stop chasing more leads. Start focusing on ready leads. That's how you build sustainable B2B revenue.

Frequently Asked Questions